While Democrats want tax increases on the table in debt negotiations, Republicans have reiterated their “no tax-hike” stance — a position they reiterated following… [the latest] unemployment report that revealed only a measly 18,000 jobs were created last month.

In reality, 18K jobs in an economy the size of America’s is so horrifically minuscule that if President Obama truly understood the ramifications of these numbers, he’d crawl under his desk until someone came to take him away. 18,000 jobs = EPIC FAIL by even a statist’s definition.

As the Baron said over coffee, the mistake the Republicans made this past week was in even considering “negotiating” with the Dems. Democrats don’t “do” good-faith negotiation; that attitude is a top-down problem, starting in the Oval Office and sifting finally onto the heads of us regular folks. Obama thinks we shouldn’t be worrying about things like the debt. In the short video below the fold, O tells us to go out and live our ordinary lives and let the professionals take care of the Debt. In other words, please don’t notice that he has no idea how to fix this mess. But he doesn’t need to know; he’s the One We Were waiting For. He’s Godot.

HF continues:

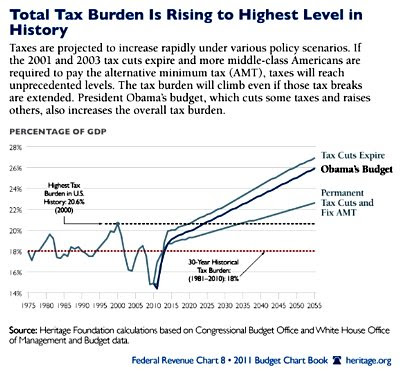

If that [the 18K jobs increase] isn’t enough reason to keep Democrats from proposing tax increases, perhaps the ambiguity of our nation’s economic future is.Americans are set to face the highest tax burden in history. Families will be hit by unprecedented taxation levels by 2020 without the extension of current tax rates. This means more economic stagnation and less prosperity.

What part of Obama’s “I won” rulebook do Republicans not understand? Present-day Dems do not negotiate, they strong arm, smear and threaten. (Think of the nomenklatura minus assassinations.)

HF presents the evidence from the American Legislative Exchange Council, though the average American hardly needs persuading:

[Blogger image sizes are limited. To see a larger version of the chart go here].

In that same post, the Heritage Foundation gives the credit to ALEC:

The American Legislative Exchange Council has found that higher taxes, new spending, and more debt will deepen the financial crisis. If tax hikes are included in any sort of deal, it is only a matter of time before workers, employers and the entire nation are burdened by more than they can handle.

The Debt isn’t rocket science, but our president says Americans shouldn’t worry their cute li’l heads about it. This subject is for professional politicians only:

Hubris much?

[Thanks to CNS for the video]

The man’s evasions, condescension (not to mention his high-fivin’shuckin’ and jivin’) continue to astound. In reality, he’s clueless about how the free-market system operates. Or rather, what of it he understands, he dislikes. He didn’t make his millions by starting up a business and hiring people. Instead, he learned early on to milk the Government Goat and he thinks y’all should do the same.

The lawyer/blogger at Legal Insurrection perfectly posed our

The only way for Obama to stimulate the enormous private sector job growth needed to ensure Obama’s reelection is for Obama to announce he is not running for reelection, which would unleash a wave of investment and economic activity not seen since the Great Depression.

This ginormous problem is “Obama’s Catch 2012” and it should catch on… so to speak. If the Republicans don’t send that one viral, then they’re even more clueless than we’ve been led to believe by watching their naïve behavior in trying to negotiate with Democrats. They’ve now set themselves up by the mere act of sitting down with the Treachery Team: now if they refuse to raise taxes the Dems will say Republicans don’t care about The Debt. However, if they agree to the Dems’ terms for upping the tax rate, their voters back home will can ’em.

Will someone please tell the Republicans they won? According to our President, victory means you never have to consult with the losing side. In the other ear, mention the sad fact that the Losers are determined to take us all down with them.

Hat tip for video: Family Security Matters

21 comments:

GoV,

Do your "policy scenarios" include inflation, or does inflation affict the country ON TOP of the scenarios you mention.

thanks

cumpa

Let me see if I understand your question.

By policy scenarios in scare quotes are you asking if a post on a specific part of the economic situation, in this country or elsewhere, is part of our mission statement, which is to fight against Shariah and support Israel?

If that is your question, the answer is: tangentially, yes.

To respond more fully, since you are not a long-time reader (I am presuming this from some of your comments)---

We report on the things in the culture that strengthen or weaken it. Before my energy became so limited, I did a lot more posts on American politics including the economy, education (or lack thereof) and associated degradation-of-the-culture subjects, like bloated unions in the US.

The Baron also posts poems on occasion. We tend toward intellectual pursuits and interests, so almost anything is fodder.

IOW, cumpa, we have a mission statement, but it's not an obseesion statement. To paraphrase a very good book, "all God's dangers ain't a Muslim..."

However, when one of us posts a subject which interest us, we don't expect that folks will want to follow all of them. In fact, it's good that this is not the case.

I fully expect this one to be passed by. It's not a red meat subject for the readers who comment here frequently. However, we could post on any of the following and the comments section would bulge:

* Russia

* Race

* Jews

* Gender

* Atheism vs Christers...

I'm sure there are other hot buttons. Fjordman could probably list them.

We don't post pr0n or hot babes in various slutty poses, but many defenders of Western culture certainly do. More power to 'em though as one fellow told me, it sure brings in the traffic from the Middle East in the wee hours.

---------------

Our blog is on auto Twitter feed. I notice the retweet notifications are about equally divided between Counterjihad themes and culture wars...it varies.

I trust this answers what I think was your question. The Baron looked at your entry & asked if I understood it since it was unclear to him. Thus, I am responding to what I *think* you asked, but correct me if I got it wrong.

---------------------

BTW, I was disappointed that ALL of you seemed to stop dead after I submitted my request for y'all to step up and speak out on You New's suggestion in that last long thread on "The Intellectual's Fall From Grace".

The ensuing silence was remarkable...

I see that an alltime high B.O. (before Obama) was 20.6% in 2000.

As a European, I am interested what this represents, is it the purchase tax on retail goods (has been 20% here for a long time now).

Or is it income tax on earnings (them's about 42% for normal earners here) or is it mandatory health insurence (10% here).

Or is it just the total amount of business tax generated, including profit tax, unearned income and purchase tax?

Sorry, but I know I have misunderstood, nobody could complain about a total of 20%.

(We even have energy tax, CO2 tax, on top of the purchase tax, some goods in Europe are 60% tax.)

whoa...

I was merely asking the question whether or not you guys had factored in hyperinflation into your scenarios.

It was an honest question, not a loaded one. There are no implicit criticisms involved. It was just a QUESTION, thats all.

There is a lot of talk about hyperinflation nowadays, and I wasn't sure whether your chart reflected it.

I was merely curious to see just how bad things got once inflation was taken into consideration.

Morbid curiosity is the beginning and end of it.

okay?

My quotation of "policy scenarios" was meant for accuracy, not sarcasm (although I can see why you might have taken it that way).

As far as YouNew's suggestion....perhaps I wasn't online at the time!

Its your blog, you have a right to do what you want, whether its two posts or whatever.

Look. If you guys are so sore at me for whatever it may be, just tell me to kindly leave your blog, and I'll do so.

I don't like sticking around in gray areas. Either I'm okay, or I'm not okay.

Your call.

gsw asked:

is it the purchase tax on retail goods (has been 20% here for a long time now).

Or is it income tax on earnings (them's about 42% for normal earners here) or is it mandatory health insurance (10% here).

Or is it just the total amount of business tax generated, including profit tax, unearned income and purchase tax?

The chart represents federal taxes only so it's not a complete picture of our tax burden.

Federal tax revenues include all the categories you named.

However, state and local tax burdens (or not) can make personal fiscal reality quite different. IOW, where you live matters.

It's complicated. Here is a ranked listing of "Tax Freedom Day" for each state:

Tax Freedom Day by State, 2011

Compare that to your burden, here:

Tax Freedom Day UK

The recent rise in your tax burden seems to be due to increases in the VAT... a BBC report from December agreed with that assessment.

Americans are congenitally allergic to taxes. Remember why we fought that Revolution: fury about a symbolic tax laid on the American colonies by the Crown to remind us who was really in charge.

"No taxation w/o representation" summed up a growing public sentiment re the desire for total independence.

Americans are ornery. Despite the socialist elites who control media, education, bureaucracy etc., regular folks see govt as bound to morph into a Max Weber-type world. As Bill Quick says, Socialism is the opiate of the mass media.

NOTE: The higher the tax rate in individual states, the more fiscal trouble they’re in. Most often they are states with huge "public sector" unions & subsequent budget breaking pension deficits.

The chart is surface interesting in that it shows the looming Fed insolvency. But the crumbling will begin at the bottom, in localities.

I think that this is very much on topic for the counterjihad, simply because of the long-standing tranzi-progressive/jihadi axis.

Destroying the US economy, and destroying the lives of American Christians and Jews, cripples our ability to resist the jihad.

@ 1389--

This particluar subject, Obama's hubris/fear/cluelessnes re the American electorate, is creating a lot of pushback, even in the MSM.

Here's one from the Fiscal Times:

Mr President: America is Paying Attention to the Debt Ceiling

When you click on the essay notice the writer got dumped on by commenters for her dismissive remarks about the Tea Party "nuts".

It's interesting that the one socialist commenter there, who believes that taxing the wealthy is a solution, doesn't seem to know the difference between The Debt and The Deficit. Sad...

Republicans are total bozos for not understanding that they are there to take the fall, not as partners in any real negotiation. They are mere props for Obama's "wise parent weary of dealing with squabbling children" act.

Reading this excellent piece on the economic side of our lowered resistance levels to Islam, I immediately wondered about the FED fuelled monetary policies and the veritable destruction of the dollar. It also reminded me of a spirited exchange I had with the Baron some time ago, about the legality of the US income tax ;-)

Monetary inflation in service of the state works like a dream for the politically well connected (all across the spectrum), since fiat money, created out of thin FED-air, first becomes available for the "political entrepreneurs" (instead of the free market entrepreneurs) whereas at the end of its trickle down way through the wider economy, the effect of this new money ultimately lands on the heads of us, the people, in the form of prices going way up. This stealing from the poor commoner while favouring the political profiteer, known as the Cantillon-effect", sprang to my mind, as I reckon it did (mutatis mutandis) with commenter @cumpa_29.

All in all a great article and I'm delighted and thankful Dymphna, that you still have energy available for these kind of pursuits.

Take care and all the best from Amsterdam,

Sag.

(P.s.: sure hope a little envelope, sealed with a "Sag Guavera" sign, will find some US postbox any time soon now..)

Tax Freedom Day:

Thank you!

It's interesting you raise this article Dymphna, because I had a brainwave recently - put sunset clauses in every part of the Tax Act in every level of government. It's a very nebulous idea, but I reckon if any country would adopt it, America would be first.

@ laine--

I'd agree that some of them are. The more ambitious ones at any rate. But there are a few who get it; most of these are in the House, not the Senate. And many of THOSE are freshman.

There are also some strong governors. The experience gained as a state's executive is probably the best training for occupation of the Oval Office.

Unfortunately, we have as our Chief Executive a man with no experience of any kind, except for raising money. Had he been white or hispanic Obama would've been lost in the shuffle. Because of our continuing desire to put the sordid history of slavery to rest we managed to elect our very first Affirmative Action president. See Joe Biden's remarks about that...

If you're saying the game is skewed in favor of the Dems, I agree. Google this: [Media in Tank for Obama] & you get more tahn 59 million hits. Change the key word to Democrats & it lowers to 7.7 million hits.

The major players, from unions to media to the permanent bureaucracy to academia to Big Biz, are long since bought & paid for by the DNC. One Big Biz example is General Electric; paid zero corporate taxes last year.

When that unholy alliance comes crashing down (or crumbling, who knows?), things will change. But plus ça change, right? The New Elite will look much like the OE.

The problem (one of the problems) for the Republicans is they're caught between a rock and a hard place. The rock is the folks back home in their district who elected them w/ standing orders to roll back govt; the hard place is D.C. inside-the-beltway political reality. It's an ugly place with a killing pace.

And the game is fixed. A Republican has to be as innocent as a dove and as wise as a serpent. Seems as though individual members get one or the other of those requirements down pat; seldom do they manage both.

The old-fashioned Dems who managed both have vanished, pushed out as irrelevant.

oops, forgot to link to a great take on the current mess(age) from our Feckless Fear Monger:

Raise Taxes or Granny Gets it

At a press conference yesterday, Obama demanded that Republicans not only authorize trillions of dollars in new borrowing,which at this point seems unavoidable, but agree to what he called “massive, job-killing tax increases” effective in 2013—i.e., after what he expects will be his re-election.

For this he drew plaudits from what used to be called the mainstream media. “Obama Grasping Centrist Banner in Debt Impasse” read the New York Times headline. The Washington Post’s Chris Cillizza dubbed him “Dad-in-Chief,” explaining: “Boil Obama’s message down and you get this: Adults sometimes have to do things that they don’t want to do. This is one of those times. So, let’s get it done.”

The kids are acting up, so he threatens to starve Granny to death. That’s just how a strong father behaves.

It looks to us as if Obama may once again be overestimating his persuasive powers by relying for feedback on journalists who, for a combination of ideological, partisan and personal reasons, are predisposed to take his side...

RTWT!

@ Sagunto--

Wow! That link is a treasure trove of information. The work required simply to accumulate all that material must have been a labor of love. They surely aren't doing it for the money ;-)

If anyone wants an education in economic theory, that's the best site I've ever seen.

Here's the home page:

Economic Theories

In an interesting (and maybe Freudian??) typo, the only woman economist I could spot (and I wasn't looking for the fems until I noticed one) is named Joan Violent Robinson. As one drills down into her work that startling middle name morphs into Violet.

Joan Violet Robinson's Economics

From a brief look at her bio, Ms. Robinson appears to have been prolific and long-lived (the latter certainly helps the former. Would that we could say the same for Bastiat - he died waaay too soon.)

She Worked in her field from before WWII and on into the 60s at least. When I saw "in close association with Keynes" I lost interest. So many others on that list whose work is NOT Keynesian. That dude's influence played a large part in the ruination of the American economy.

Nonetheless Ms. Robinson's very existence is a most intriguing factoid.

I'll put the URL aside for our blogroll clean up.

@ gsw--

"Tax Freedom Day" is an idea that hasn't spread fast enough. However,the ppl who do know keep their day marked prominently on calendars at their workplace.

The embedded information in such collations allows those who are trying to flee the burdens imposed by Taxifornia or Taxachusetts to make better decisions.

The latter already know they can head to New Hampshire or Maine, yet still stay in New England.

Californians flee to Colorado, Oregon, and Texas. Those massive flights have changed the political hue of Colorado. Oregon was already blue & full of Kumbiyah socialists.

Those going to Texas include many M.D.s who know the legislature has built protections for them against the vulture lawyers (John Edwards made his millions suing hapless docs).

For Americans wanting to flee their current burdens, here is a listing of states without personal income taxes:

State income tax

The wiki also includes a good map (with some surprises) and a listing of the rates at which businesses are taxed.

I am most sympathetic to the idea of some form of flat tax. Our tax code is enormous, complicated, and the IRS has too much power. Some call it the KGB.

@ LAW Wells--

It's a good idea but you can imagine the light-to-heat ratios in any "debate" re your proposition.

What we need too, and this one might possibly be reachable, is a Sunlight Law.

One of Obama's many broken campaign promises was for more transparency in govt. If anything it has growon more opaque under his reign.

Here is a group set up to "make govt transparent and accountable":

Sunlight Foundation

I haven't looked at it lately, but I've been meaning to check out any info they may have on the expansion of the executive functon via extralegal moves like "Directives". These allow the EPA to enforce ideas (rather than laws) that the greenies like.

At least y'all have the advantage in OZ of having your greens out in public where you can keep an eye on 'em...we're stuck with their wrecking balls hidden behind bureaucratic walls and whacking away under the radar. The MSM ignores their nefarious work.

Dymphna -

There's another site that, for me at least, is one to cherish, which is of course the Ludwig von Mises Institute in Alabama.

They've got the "Bastiat Collection" and "Human Action" by Von Mises (one of the most important books on economic theory ever written).

I paid them a mere 30,- Euros (shipping to Holland included) for about 2000 pages of pure gold ;-)

Now thát's value!

Take care,

Sag.

@ sag--

Speaking of Euros...I got to thinking about the huge list on that economic theory site and went back to look for Nobel Prize winner Robert Mundell.

Not there! No supply side theory of any kind that I can see. Wow.

he's Canadian. They're used to being overlooked, but my heavens..words fail me.

The wiki:

Robert Mundell

He received the Nobel Memorial Prize in Economics in 1999 for his pioneering work in monetary dynamics and optimum currency areas.

Mundell laid the groundwork for the introduction of the Euro through this work and helped to start the movement known as supply-side economics...

and

The Mundell International University of Entrepreneurship in the Zhongguancun district of Beijing, People's Republic of China is named in his honor...

What a disappointment.

And no Cobden! Sheesh. He was an influence on Bastiat. From the Bastiat wiki:

Bastiat asserted that the only purpose of government is to defend the right of an individual to life, liberty, and property. He was also a strong supporter of free trade. He "was inspired by and routinely corresponded with Richard Cobden and the English Anti-Corn Law League and worked with free-trade associations in France.".

Something tells me this site has much to offer from the Keynesian perspective but not the real conservative wing of European economic history which has been muffled...or so it seems from this distance.

BTW, the Acton Institute offers various Bastiat tracts. They are in the forefront of training young entreprenurial types from all over, including South America...definitely Catholic, but definitely at odds with the official position of the Council of Bishops...who really ought to stick to ecclesiology. Or study some theory first.

Acton's mission statement includes a goal to return the moral edge to entrepreneurship. A bold project.

Dymphna -

"the Acton Institute offers various Bastiat tracts. They are [..] definitely Catholic, but definitely at odds with the official position of the Council of Bishops...who really ought to stick to ecclesiology. Or study some theory first."

As some commenter would say in his best English: le Bingo! ;-)

They (the bishops) are most probably also blissfully unaware that this official position is at odds with the substantial contribution of the Church to free market philosophy and economic theory (price theory; private property).

Two books I'd highly recommend in this regard (besides the couple I mentioned earlier, I mean 24 bucks for Mises and Bastiat, it's a steal..) are:

- Thomas E. Woods: The Church And The Market: A Catholic Defense of the Free Economy; (Lexington Books, 2005)

- Alejandro A. Chafuen: Faith and Liberty: The Economic Thought of the Late Scholastics (Lexington Books, 2003)

The work by Chafuen draws upon many texts that are unfamiliar to English-speaking audiences. It illustrates that the origin of modern economics lies very much in natural law and scholastic moral theology. Now if only any of these bishops would read this book, which would effectively mean a reacquaintance with a long lost tradition of their own Church..

The book by Tom Woods is a gem in his own right, as are most of his books, including his recent "Meltdown". He's a fine speaker and an ardent supporter of Ron Paul and I've said this before: if only he and others like him would allow themselves to be informed by you guys about Islam, and if only some prominent CJ frontmen would lend their ear to sound (Austrian school) economic theory (and consequentially move away from this false opposition between Con/Dem's), then we'd really have a Tea/Beer/Beef Party, and a coalition of hope and actual prospect. Sort of Col. Allen West meets Ron Paul, mutually "enlightening" each other. If only..

The Acton Institute is doing a great job indeed. If you visit both their site and Mises.org, you can't go wrong on economics (didn't know the other site, that was just a link to a fine description of the Cantillon-effect). The Mises site is a real treasure containing many worthwhile authors, offering complete works in pdf, lectures by seasoned scholars in mp3 and various video formats, like Ralph Raico's, who knew, and worked with, both Hayek ("he liked too many people") and Rothbard. Here's a thoroughly enjoyable lecture by him: Ralph Raico on Liberalism. Enjoy [14:55 infamous Ipod-joke].

Thnx for the exchange and take care. Today I'm meeting up with a CJ brother in arms from the US, over here in Amsterdam. We'll have a toast to your health (and the Baron's as well, of course).

Certa Bonum Certamen!

Kind regs from Amsterdam,

Sag

Post a Comment