…rationality holds out two possibilities for explaining the Arab crash, if we take for granted that much of what goes on economically in these countries is oil-driven. Some of these countries are awash in oil money because of surging prices in the last few years, and so either investors are betting that the oil windfall is over (although oil futures prices don’t suggest that as far as I know), or these countries have spent some of their money foolishly, and investors are suddenly passing a judgment on that. (Egypt, a non-exporter of oil, is admittedly harder to explain using this approach, although the economy is perhaps tremendously dependent on remittances from the Gulf states.)

In addition, see Starling David Hunter in the comments for an amusing Saudi stock market tale. And also visit his blog. Interesting business stories, posts from his students there (he teaches in the UAE) and besides, look at his photo… what a hunk.

Larry Kudlow is reporting some intriguing figures for stock markets in the Middle East. They are in big trouble:

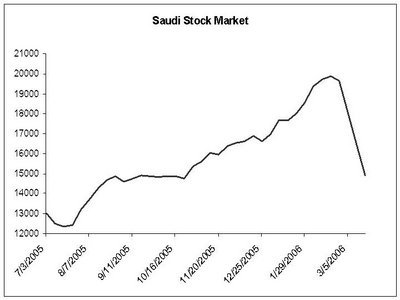

Shares in Dubai were off close to 12 percent yesterday [on March14], while Saudi Arabia's Tadawul All-Shares index returned almost 5 percent of its gains. The Saudi index closed trading at 14,900, shedding almost a quarter of its value since reaching a record high of 20,635 in late February. Egypt's index hasn’t fared any better. It is down 22 percent from its February peak. Similar plunges were felt by a slew of other markets in the region, including Kuwait, Morocco and Jordan.

So what does this mean? Probably a bubble burst that will leave the region less arrogant about its dominance in what is a commodities market — and the only thing they have of value. Since commodities are always volatile — as are offended Muslims in the Middle East — there is a potential for problems here. Despite what the MSM says, we’re currently awash in oil… though nature can take care of that in a hurry, as it did with Katrina.

According to Mr. Kudlow:

The chief catalyst contributing to the seismic corrections was the growing concern that share prices had gotten way ahead of themselves following a three-year bull run. The failure of the Dubai ports deal certainly did not help investor psychology either. And, perhaps, there has been some discounting going on due to the possibility of lower energy prices in the future. Lower oil prices will certainly lead to lower government and corporate income in the Gulf region.

Methinks that Hamas will be on a budget real soon. Which of course, will not prevent them from stirring up the street, shooting off guns and their mouths with those tired old slogans about Joos.

You know that those money-grubbing, powerful Zionists are behind this, don’t you? With Egypt’s stock market going down the tube, they will need our aid more than ever, and will continue to back organizations like the Muslim Brotherhood. At least the man in the Egypt street will do so. The Egyptian government is stuck between a rock and a hard place.

So what do you think?

6 comments:

Dympha:

Interesting but which bubble burst? If I were to guess it'd be the building boom in Dubai. They were trying to turn the country into International shopping centre inc(tm) and I guess something happened (related to the American ports' deal falling through?) that caused the investors to take their money and invest it somewhere else.

I concour with the rest of your analysis that the Gulf states won'tt be so generous to the Palestinans nor the Iraqi killers. I suspect that even the proyletizing around the world will also have to decrease quite noticeably. Let,s see if the violent surge we've seen, cools down.

xavier

Disagree that the MSM denies that the world is 'awash' with oil. Consider the New York Times, happily running an advertisement from Exxon saying that Peak Oil is nonsense, whilst publishing an editorial opinion (only on-line for susbcribers, not printed) saying that 'Peak Oil is real'. However, the US military understands the situation, as does the US Army Corps of Engineers. Look at their recent reports on the issue - they are forced to be reality based, unlike the MSM.

Dymphna:

I've always wondered if there were shaky assumptions underlying Dubai's desire to invest in a tourism and luxury industry that no doubt caters to a very particular market.

The upside is that luxury goods continue to sell well in bad economic times.

But essentially, all theyre doing is paying architechtural firms (wonder where they were trained...) out the wazoo to build not Taipei 101s, but Luxors.

Amidst all the fetishized hoopla that surrounds Dubai is of course the longlived and proud tradition of heralding America's invetiable-but-not-a-moment-too-soon-

decline:

"Not finding the U.S. or our economy particularly inviting since the war on terror, many Arab investors have turned to Dubai, and the proof is in the skyline. The riviera is a cluster of cranes and scaffolding, punctuated by skyscrapers that cut impossible streaks into the sky. An indoor ski slope. An underwater hotel. The tallest building in the world, shaped like a giant lighting rod. No more room on the beachfront? No problem. They simply manufacture more."

So they can sell mansions to celebrities?

the above example of hilarious enthusiasm for an Arab Planned-economy is made possible by your friends at Public Radio International...

Yeah so Dubai is securing its economy for how many years with underwater hotels and skislopes? Whats the return on these investments? Wow, how visionary those Arabs are...can they just come over here and start administering my town plz?

I sure hope they are spending at least as much on the Dubai Institutes of Technology and Dubai Technology Parks to lovingly nurture their R&D before it bursts out into the Global markets with the ferocity of a Walkman, iPod or next gen console right? Or are these lucky endoparasites of our global energy system going to bring us the latest nanotech or a new clinical application of adult stem cells?

Nonetheless, one has to root for the parts of their society embodied in the stock market. So long as those guys have power, we don't need to deal with the Muslim Brotherhood etc.

Historically, market highs are characterized by irrational exuberance like the nearly one kilometre high skyscraper proposed in UAE, or was it Dubai?... or wherever, my memory escapes me. One kilometre up is a long way to fall.

since this is a composite index, it means that some industries were hit hard, some not at all, and that some have gained ground. it would be interesting to know which.

Just so happens I was talking with a Saudi student of mine a few days ago about the Saudi stock market. (As you may recall, I teach in the UAE.) He said that the proportion of the average population that invests in the market is extremely high. He also said that the majority are not well educated in general or about stock markets in particular.

He said that stories about people who have made it rich have lead far too many people to investment much of their life savings into the market with unrealistic expectations of high returns. I said "so it's like a big casino?" he laughed and said, "yes, but gambling is not allowed is Saudi Arabia, sir."

I wrote about this a few days ago. I don't think it has anything to do with the port situation per se. The rout started in mid-February. These events are pretty common in developing economies, the more so if they have iffy transparency and significant corruption.

It's painful, but typically reform and better governance follows. (The Saudis have already announced that restrictions on foreign investors in their stock market will be lifted, and those foreigners will demand more transparency, as they did in Asia and Mexico.) During the oil-induced boom a lot of mistakes have been funded, and now this crash will sort out the wheat from the chaff.

Starling David Hunter's comments about the extent of investment in the stock market are troubling, because a lot of these crashes occur in countries where there isn't so much participation in the financial markets by the broader population. If the unwinding continues, and if enough people get wiped out, they will look for someone to turn to in their anger. And who might that be?

Post a Comment